There is a common misconception that the Australian Labor Party (ALP) is supportive of left wing policies aimed at reducing inequality and protecting the rights of workers. However, in recent years, there has been a shift in the party's position on economic matters, with some members expressing support for right-wing economic policies. One contentious issue that has emerged is the party's stance on tax cuts for high-income earners. While the ALP argues that these cuts can stimulate economic growth, there are potential flaws that must be examined.

Proponents of tax cuts for high-income earners argue that they incentivize hard work and investment, which ultimately leads to economic growth. They contend that reducing the tax burden on the wealthy allows them to have more disposable income, which they can then invest in businesses and create jobs. This argument aligns with right-wing economic ideologies that prioritize free markets and limited government intervention.

However, critics argue that tax cuts for high-income earners primarily benefit the wealthy while doing little to address inequality. They argue that the wealthy are more likely to save or invest their additional income rather than spend it, thereby limiting the potential economic stimulus. In fact, research from the International Monetary Fund (IMF) suggests that tax cuts for the rich have a relatively small impact on economic growth compared to investments in education or infrastructure.

Moreover, tax cuts for high-income earners can exacerbate income inequality and hinder social mobility. Australia already faces significant income disparities, with the top 10% of earners accounting for around 45% of total income. By reducing taxes for the wealthy, the ALP risks widening this gap further, making it even harder for low-income individuals and families to move up the economic ladder.

Another potential flaw in tax cuts for high-income earners is the impact on government revenue. The ALP has traditionally advocated for strong public services, such as healthcare and education, which require funding. By reducing taxes for the wealthy, the government's ability to generate revenue is compromised, potentially leading to budget shortfalls and reduced investment in essential public services.

Furthermore, tax cuts for high-income earners can undermine the ALP's commitment to addressing climate change. The party has recognized the importance of transitioning to a low-carbon economy and has outlined ambitious renewable energy targets. However, implementing these policies requires significant investment in clean energy infrastructure and research. By reducing taxes for the wealthy, the government may struggle to fund these crucial initiatives, hindering progress in combating climate change.

It is essential to consider the potential consequences of tax cuts for high-income earners through a data-driven lens. A study conducted by economists Emmanuel Saez and Gabriel Zucman found that the top 1% of earners in Australia pay an effective tax rate of around 30%, significantly lower than the top marginal tax rate of 45%. This suggests that there is room to increase tax revenues from high-income earners without adversely affecting their incentives to work or invest.

Furthermore, the same study revealed that the share of total income going to the top 1% has increased from around 5% in the 1980s to nearly 10% in recent years. This growing concentration of wealth highlights the need for policies that address inequality and ensure a fair distribution of resources. Rather than implementing tax cuts for high-income earners, the ALP should consider alternative measures, such as increasing the progressivity of the tax system or closing tax loopholes that benefit the wealthy.

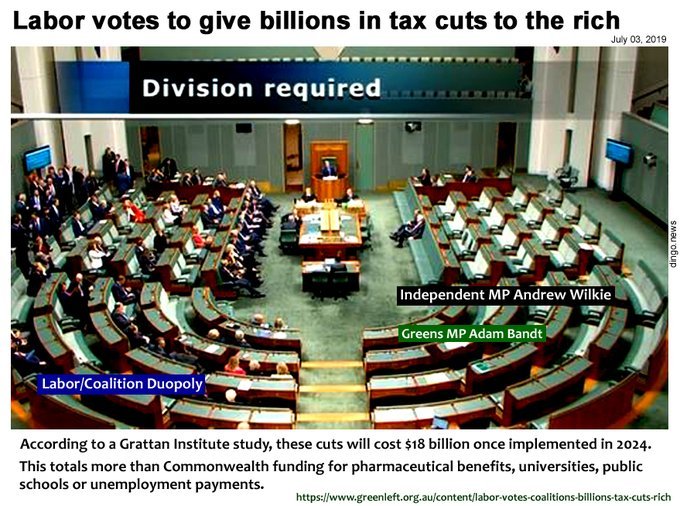

While the ALP's support for right-wing economic policies, such as tax cuts for high-income earners, may be driven by the belief that they can stimulate economic growth, as we have shown there are serious flaws with this approach. These cuts primarily benefit the wealthy while doing little to address inequality and can hinder the government's ability to generate revenue for public services and climate change initiatives. The ALP should explore alternative policies that prioritize fairness, social mobility, and sustainable economic development.

Analysis & Opinions by ProgressiveLeft.net